Competitive interest rate and No Taxes withheld on interest earned from deposit

Regular Savings

Regular Savings

A savings account is one of the simplest types of accounts. It allows you to store cash securely and earn interest on your money.

- Each member of the cooperative shall maintain a regular saving deposit account

- Initial deposit of P1,000 is required to open an account and order to gain interest.

Why you should open a saving account today:

- Saving account encourages saving habit among salary earns and others who have fix income

- It enables the depositor to earn income by way of saving interest

- It provides immediate funds.

ATM Savings

ATM Savings

Save funds in this affordable ATM cards

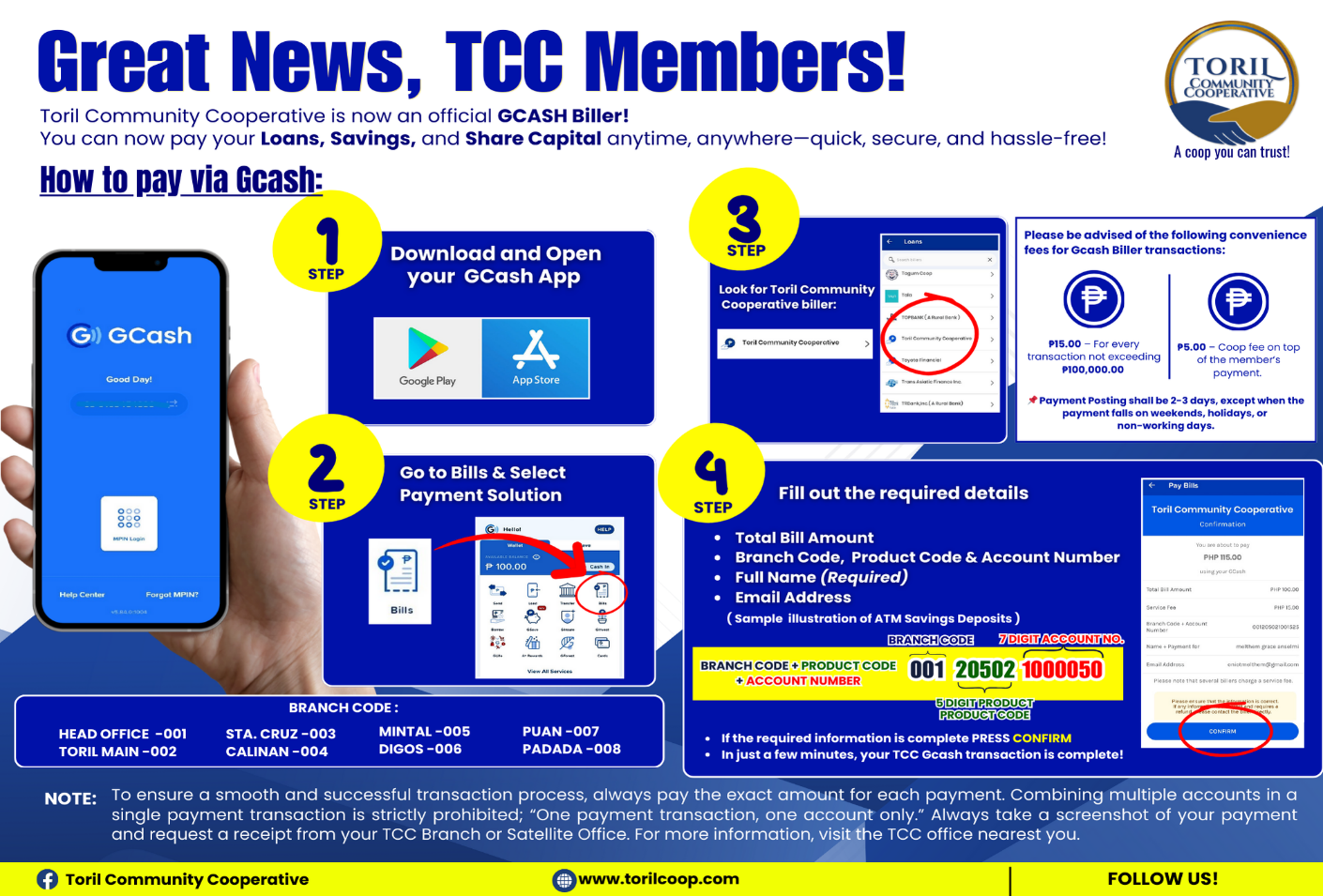

- Inquiry – inquire for the current & available balance to any ATM terminals nationwide.

- Withdrawal – allows the depositor a maximum of P10,000.00 per withdrawal or P50,000.00 withdrawable amount per day to any ATM terminals nationwide.

- Bills Payment – allows payment of bills over Bancnet ATM nationwide

- POS – cashless shopping (charge free)

- Inter-bank Fund Transfer (IBFT) – enables transfer of funds from one account to another account maintained in another Bancnet member via ATM with a maximum amount of P50,000.00 a day.

- Internet Banking – conduct banking activities via internet for bills payment, transfer of funds, viewing of account balances and purchasing.

- ATM savings deposit with an annual interest rate of 1%

*Service Fee and Charges

| Balance Inquiry at any PinoyCoop ATM’s | P 2.00 |

| Withdrawal at any PinoyCoop ATM’s | P 5.00 |

| Balance Inquiry to other ATM’s | P 2.00 |

| Withdrawal to other ATM’s | P 15.00 |

Trust deposit

Trust deposit

Deposits made “in the name of one person, as trustee for another” are known as “trust deposits.”

Mortuary Benefits

Mortuary Benefits

Benefits to:

- Member

- Non-member spouse

- Non-member parent of a single member

- Children below 18 years old