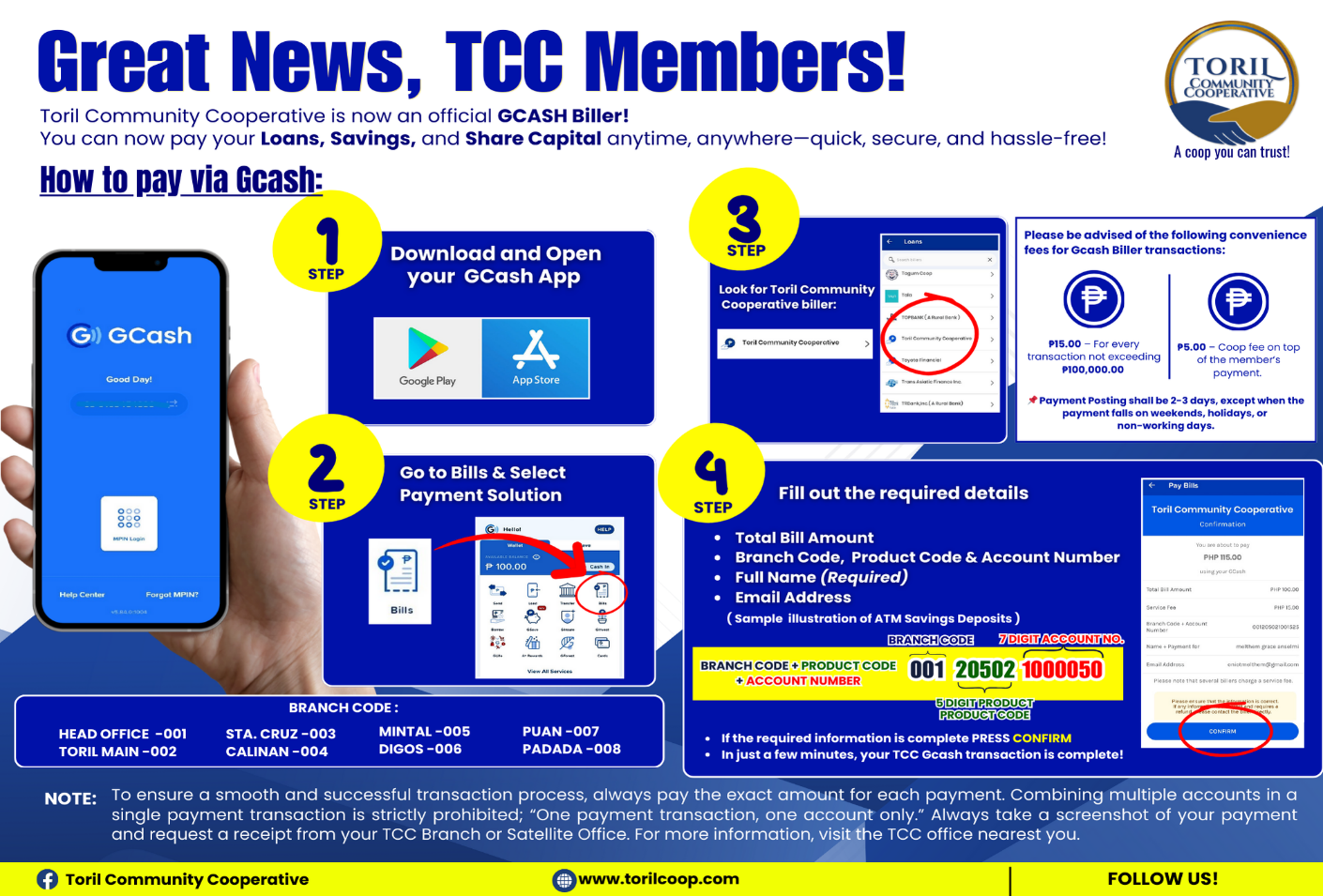

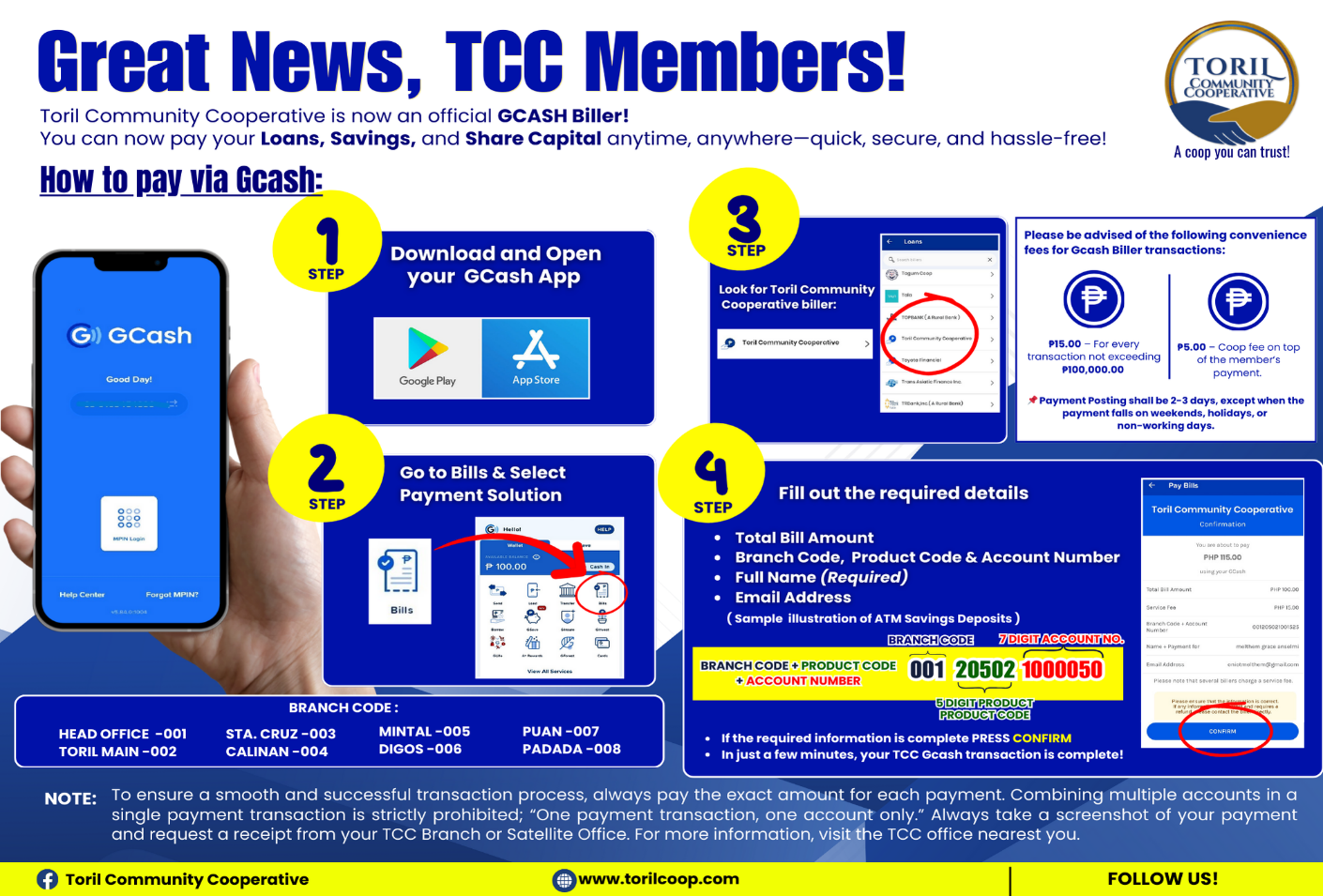

Now Available: Official Toril Coop GCash Biller

Pay your bills easily and securely using the new official Toril Coop GCash Biller. Learn more and see how it works.

Read More

Pay your bills easily and securely using the new official Toril Coop GCash Biller. Learn more and see how it works.

Read More

A Time Deposit Account is an interest-earning bank account with a fixed maturity date. It allows for substantial investments over a fixed term, offering higher interest rates than regular savings accounts. The deposited money must stay in the account for the agreed term to earn the stated interest. Key features include a fixed term, variable interest rates based on term length, automatic renewal options, and potential penalties for early withdrawal.

A Time Deposit Account offers higher interest rates than regular savings accounts, making it ideal for long-term goals. The funds are locked in for a specific period, promoting saving and discouraging unnecessary spending. It’s an effective tool for financial planning for large future expenses like buying a house or starting a business. Additionally, it’s a low-risk option for saving, investing and wealth building

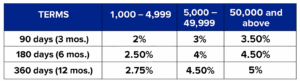

Time Deposits Rates effective June 01, 2020