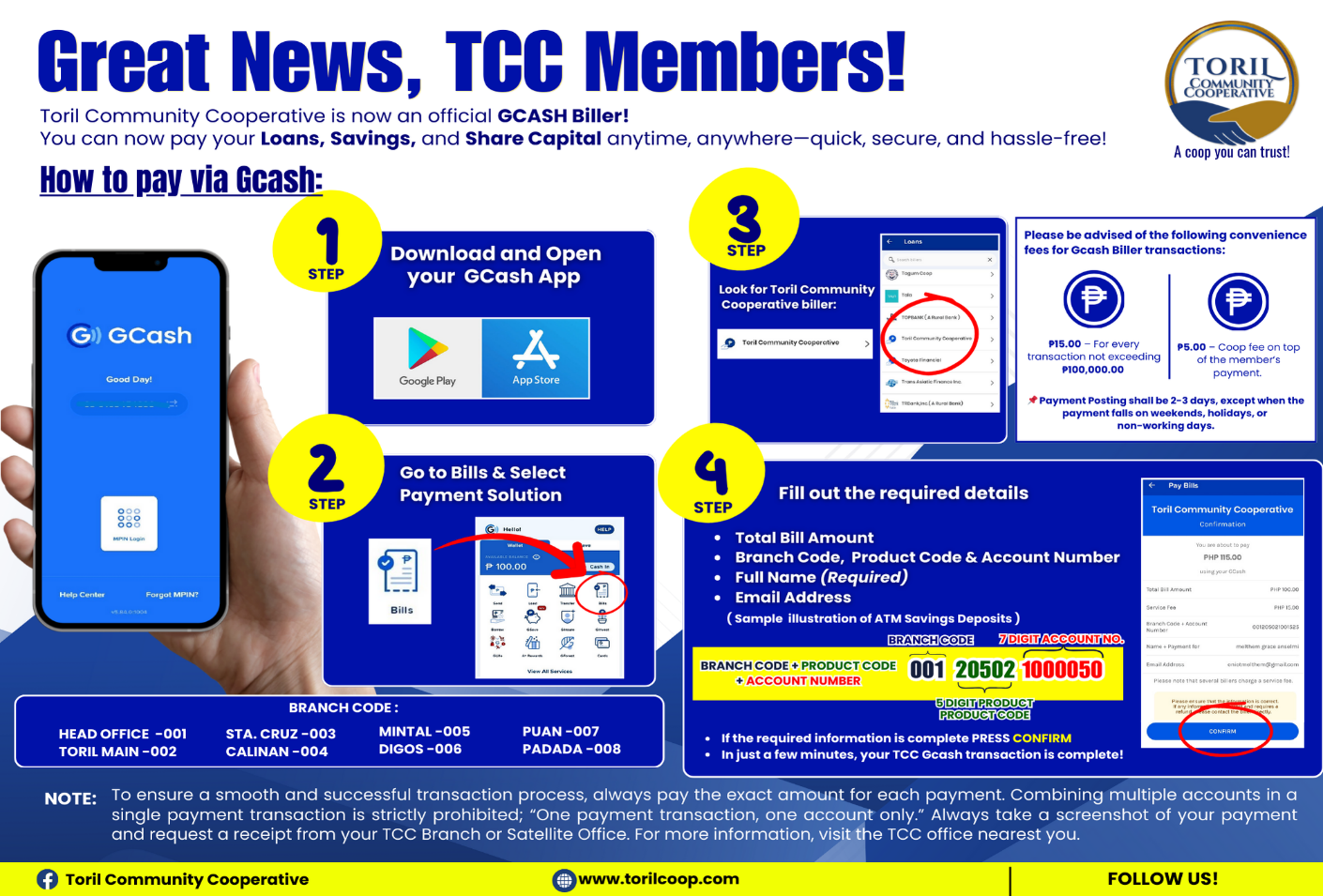

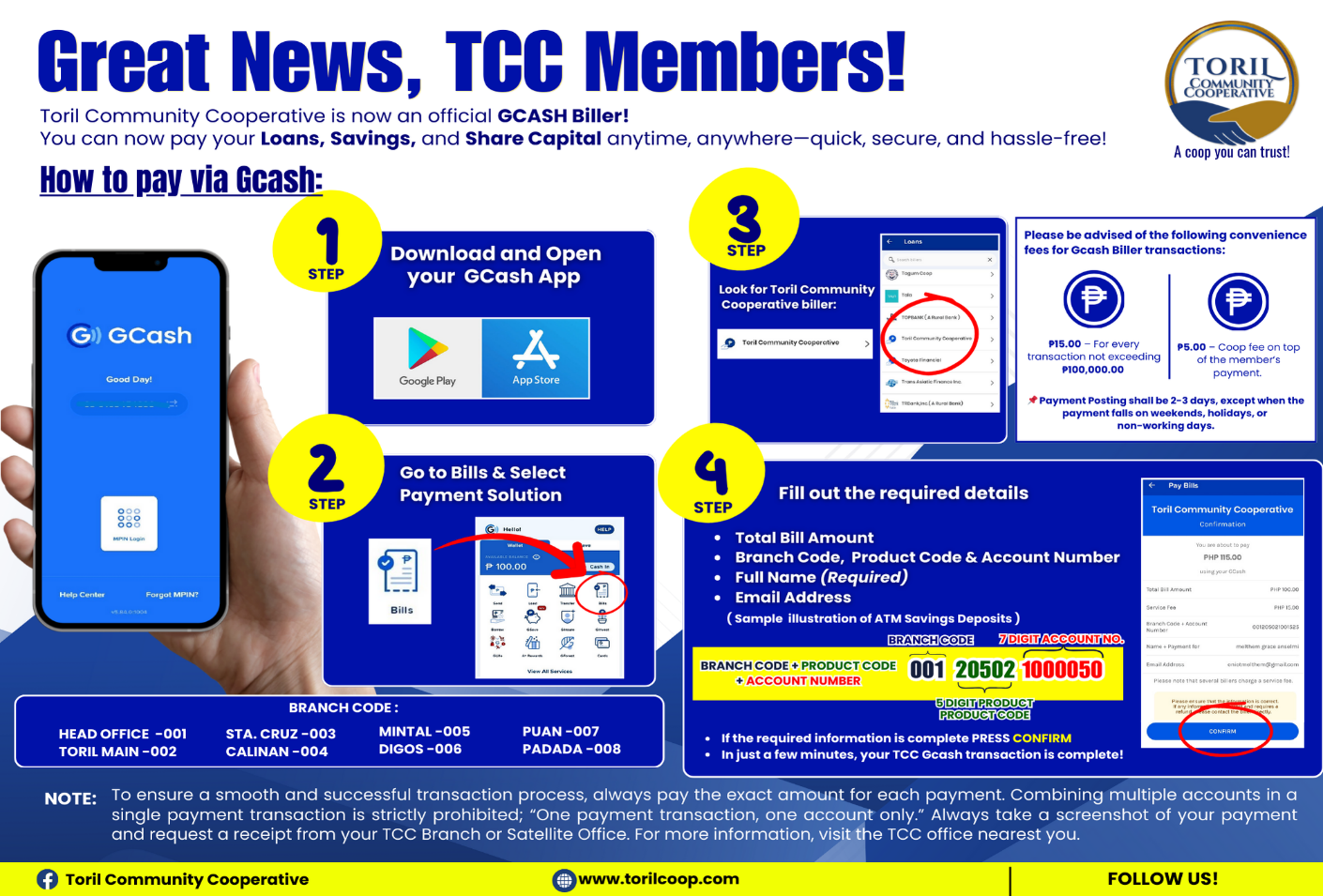

Now Available: Official Toril Coop GCash Biller

Pay your bills easily and securely using the new official Toril Coop GCash Biller. Learn more and see how it works.

Read More

Pay your bills easily and securely using the new official Toril Coop GCash Biller. Learn more and see how it works.

Read More

Is a type of savings account that is designed to help young people learn about money management. These accounts are typically available to individuals who are under a certain age, often 18 years old. Key features include age requirement, low initial deposit requirement and the ability to earn interest and with parental control.

Youth savings accounts provide several benefits:

Financial Literacy: They help young people understand banking and money management, including the value of money, the importance of saving, and how interest works.Saving Habit: They encourage a lifelong habit of saving through regular deposits.

Goal Setting: They can be used to save for specific goals, teaching the importance of planning and delayed gratification.

Low Costs: With low or no minimum balance requirements and typically no fees, they are accessible to young people.

Security: The money in the account is safe from loss or theft.

Earning Interest: These accounts typically earn interest, helping the account balance grow over time.

Parental Oversight: Parents or guardians can monitor their child’s saving habits and guide their financial decisions with these accounts.